Things about Estate Planning Attorney

Things about Estate Planning Attorney

Blog Article

Estate Planning Attorney - Truths

Table of ContentsEstate Planning Attorney Things To Know Before You BuyEstate Planning Attorney for DummiesGetting The Estate Planning Attorney To Work10 Simple Techniques For Estate Planning AttorneyEstate Planning Attorney - TruthsAn Unbiased View of Estate Planning AttorneyEstate Planning Attorney Fundamentals Explained

That you can avoid Massachusetts probate and sanctuary your estate from estate taxes whenever feasible. At Center for Elder Regulation & Estate Planning, we understand that it can be difficult to believe and talk regarding what will certainly happen after you pass away.We can help. Call and establish a free appointment. You can also reach us online. Offering the better Boston and eastern Massachusetts areas for over thirty years.

They can offer precise recommendations tailored to your certain situation. They help you develop a thorough estate strategy that lines up with your dreams and goals. This may consist of composing wills, developing trusts, designating beneficiaries, and much more. Estate preparing lawyers can help you avoid mistakes that could revoke your estate strategy or lead to unintended repercussions.

The 15-Second Trick For Estate Planning Attorney

Hiring an estate preparation attorney can aid you avoid probate altogether, conserving time, and money. An estate preparation lawyer can assist protect your properties from legal actions, financial institutions, and various other claims.

Cloud, Minnesota, reach out to today. To read more concerning bankruptcy,. To learn regarding property,. To learn regarding wills and estate planning,. To call us, or call us at.

The age of majority in a given state is set by state laws; normally, the age is 18 or 21. Some properties can be dispersed by the establishment, such as a financial institution or broker agent firm, that holds them, so long as the owner has actually offered the proper instructions to the financial institution and has actually called the recipients that will receive those possessions.

4 Simple Techniques For Estate Planning Attorney

For instance, if a beneficiary is called in a transfer on fatality (TOD) account at a brokerage company, or payable on death (SHEATH) account at a bank or debt union, the account can generally pass straight to the beneficiary without undergoing probate, and hence bypass a will. In some states, a comparable beneficiary classification can be added to realty, allowing that possession to additionally bypass the probate process.

When it pertains to estate planning, a knowledgeable estate lawyer can be a vital asset. Estate Planning Attorney. Functioning with an estate preparation attorney can offer countless benefits that are not offered when trying to finish the process alone. From supplying proficiency in legal issues to helping create a detailed prepare for your family members's future, there are many benefits of functioning with an estate planning lawyer

Estate lawyers have extensive experience in comprehending the subtleties of different legal documents such as wills, trust funds, and tax laws which enable them to supply audio guidance on exactly how finest to safeguard your assets and ensure they are passed down according to your dreams. An estate attorney will also be able to offer suggestions on how best to navigate complex estate legislations in order to make certain that your dreams are recognized and your estate is handled effectively.

Some Known Details About Estate Planning Attorney

They can commonly supply guidance on just how ideal to upgrade or produce brand-new records when required. This may consist of advising adjustments in order to benefit from new tax benefits, or simply ensuring that all appropriate records mirror the most existing beneficiaries. These lawyers can additionally offer recurring updates associated with the management of trusts and various other estate-related issues.

The look at here objective is constantly to make certain that all documentation remains legally accurate and mirrors your present wishes properly. A major advantage of dealing with an estate preparation lawyer is the important guidance they supply when it comes to preventing probate. Probate is the lawful process during which a court determines the credibility of a dead individual's will certainly and supervises the circulation of their assets according to the regards to that will.

A skilled estate lawyer can aid to make sure that all essential files remain in area and that any possessions are appropriately distributed according to the regards to a will, staying clear of probate altogether. Ultimately, dealing with a seasoned estate see this page preparation lawyer is one of the very best methods to ensure your want your household's future are lugged out as necessary.

They give essential legal support to make certain that the best rate of interests of any type of small kids or grownups with disabilities are fully safeguarded (Estate Planning link Attorney). In such cases, an estate attorney will help identify suitable guardians or conservators and guarantee that they are provided the authority required to manage the assets and affairs of their charges

Estate Planning Attorney Things To Know Before You Get This

Such trusts generally have stipulations which secure benefits received with government programs while allowing trustees to keep restricted control over exactly how assets are handled in order to maximize advantages for those included. Estate lawyers comprehend how these trust funds work and can provide invaluable aid setting them up effectively and making sure that they remain legitimately compliant over time.

An estate preparation lawyer can assist a parent include stipulations in their will for the treatment and management of their small youngsters's possessions. Lauren Dowley is a knowledgeable estate planning attorney that can aid you produce a strategy that meets your certain needs. She will certainly deal with you to comprehend your assets and just how you desire them to be distributed.

Do not wait to start estate preparation! It's one of the most vital points you can do for yourself and your enjoyed ones.

The Of Estate Planning Attorney

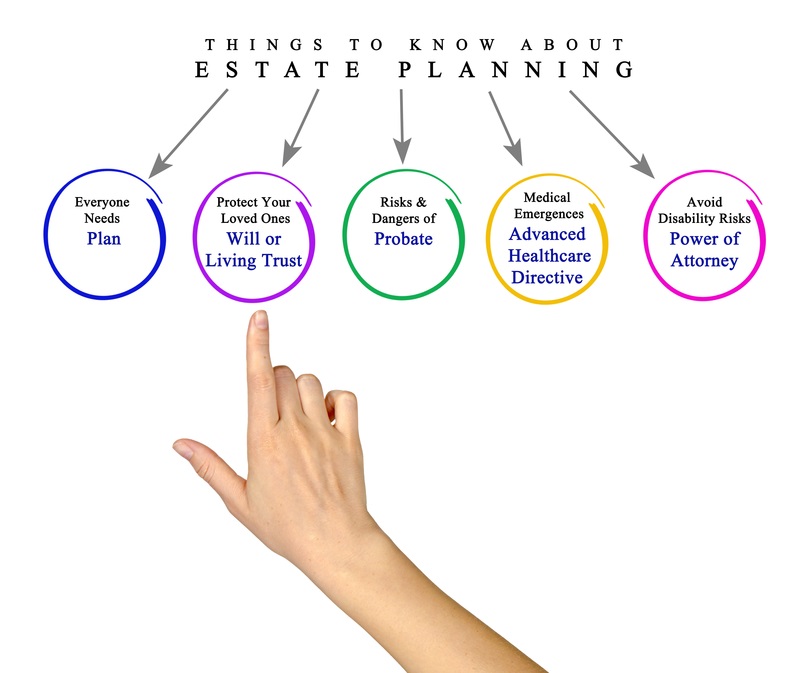

Producing or upgrading existing estate planning files, including wills, counts on, health and wellness treatment directives, powers of attorney, and related tools, is one of the most important points you can do to guarantee your dreams will certainly be honored when you pass away, or if you end up being unable to manage your affairs. In today's electronic age, there is no scarcity of diy choices for estate preparation.

Nonetheless, doing so can cause your estate strategy not doing what you desire it to do. Working with an estate planning attorney to prepare and help perform your legal documents is a clever choice for a range of reasons:. Wills, trusts, and various other estate preparing files should not be something you prepare as soon as and never review.

Probate and count on laws are state-specific, and they do transform from time-to-time. Working with a lawyer can provide you tranquility of mind understanding that your plan fits within the specifications of state law. One of the most significant pitfalls of taking a diy approach to estate planning is the threat that your papers will not really complete your goals.

The Basic Principles Of Estate Planning Attorney

They will think about various scenarios with you to draft files that precisely mirror your desires. One common misunderstanding is that your will certainly or trust fund instantly covers every one of your possessions. The fact is that particular sorts of home ownership and beneficiary designations on properties, such as retired life accounts and life insurance policy, pass separately of your will or depend on unless you take steps to make them work together.

Report this page